Compliance is getting more and more important over the last several years for blockchain-related startups. At the core are certain checks with industry-standard tools to make sure that the subscribed investors is not related to politically exposed persons, or might even be wanted or related to fraud cases worldwide. So usually most of the KYC checks on Investors are rather straightforward but the compliance partner needs to make sure that latest checks are a state of the art to make sure that none of the investors are related to money laundering or terrorism finance. This is achieved with several layers and we are very keen to follow them with industry experts from consulting firms over to one of the leading blockchain bank in Liechtenstein Bank Frick.

Software to help compliance

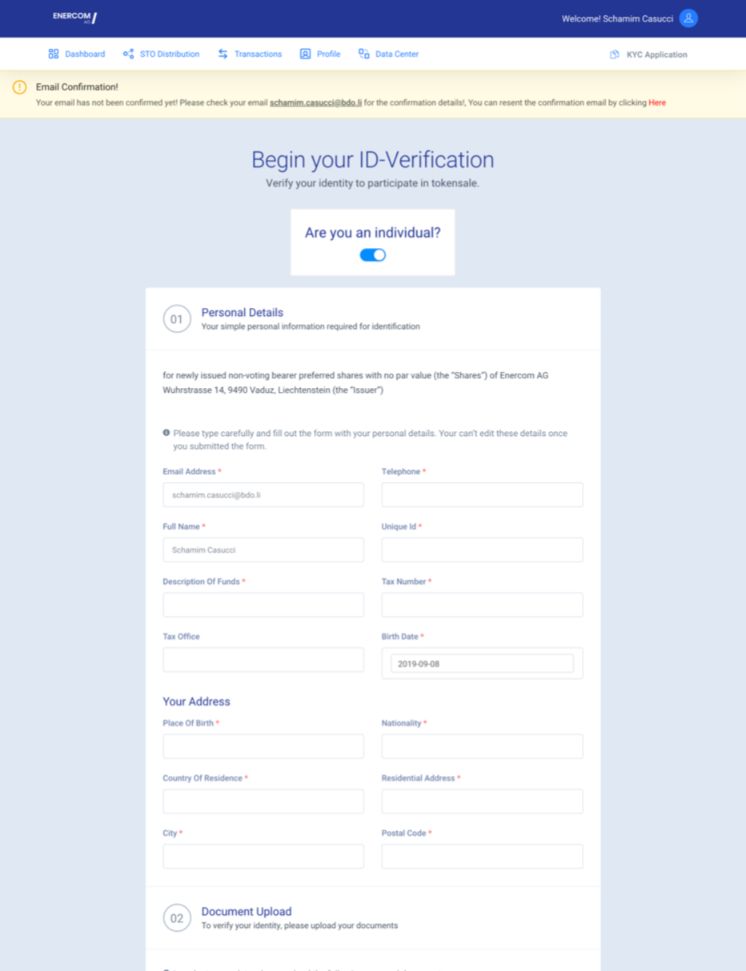

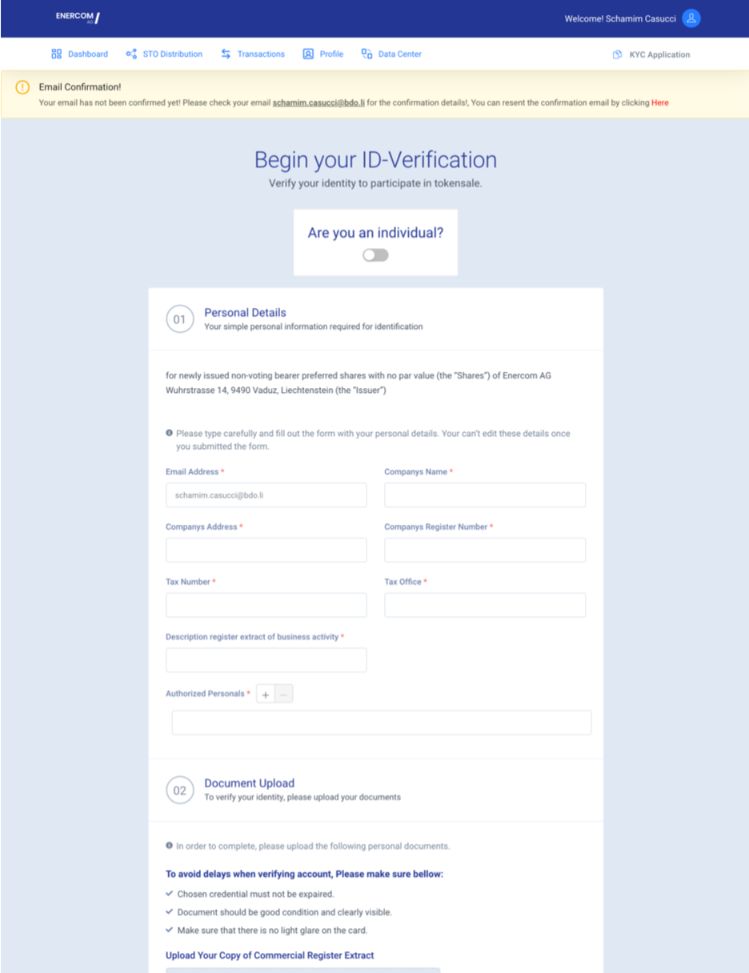

We are onboarding individual persons but also corporates slightly differently with regards to fields which we ask to fill out so that our compliance partner can do their job faster, better and with fewer errors.

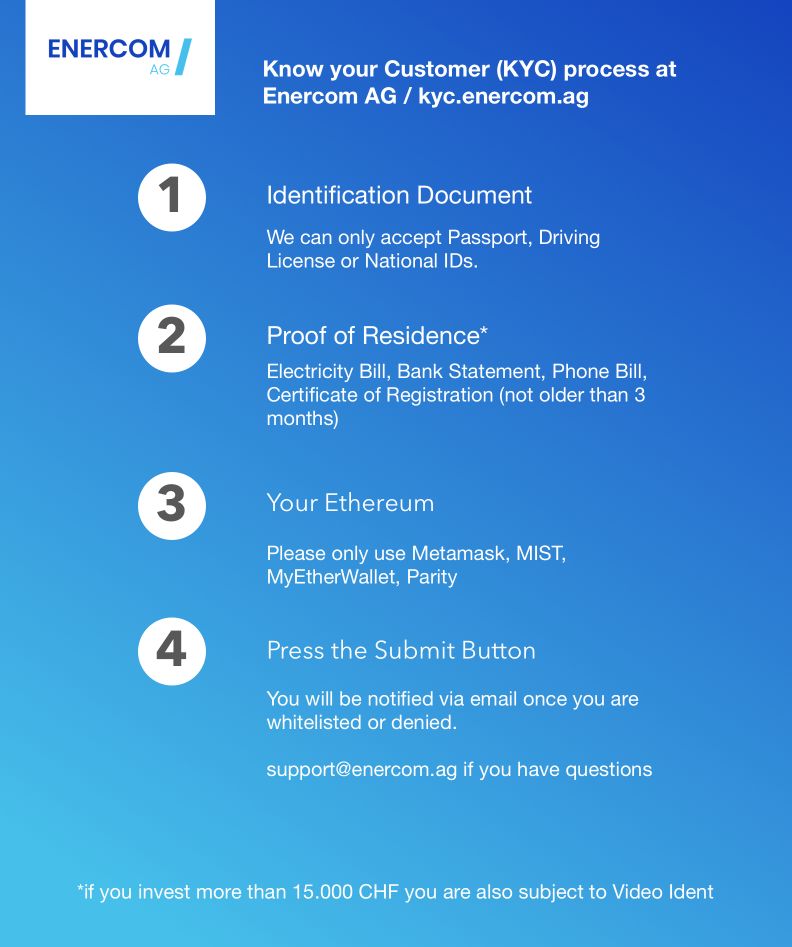

You can start your KYC Application here kyc.enercom.ag only whitelisted Investors (who are approved through kyc.enercom.ag will be able to invest)

Different level of KYC details

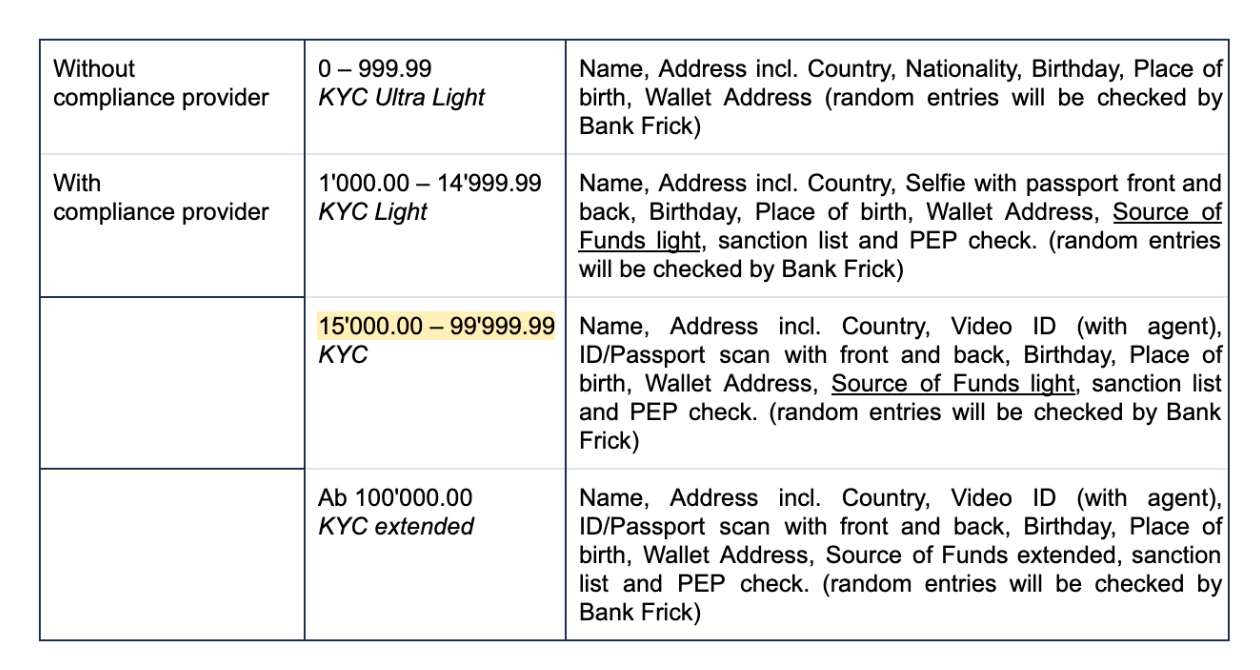

Furthermore, we have certain levels which are required by the Bank compliance to make sure to follow – this is aligned with our compliance Partner BDO Liechtenstein.

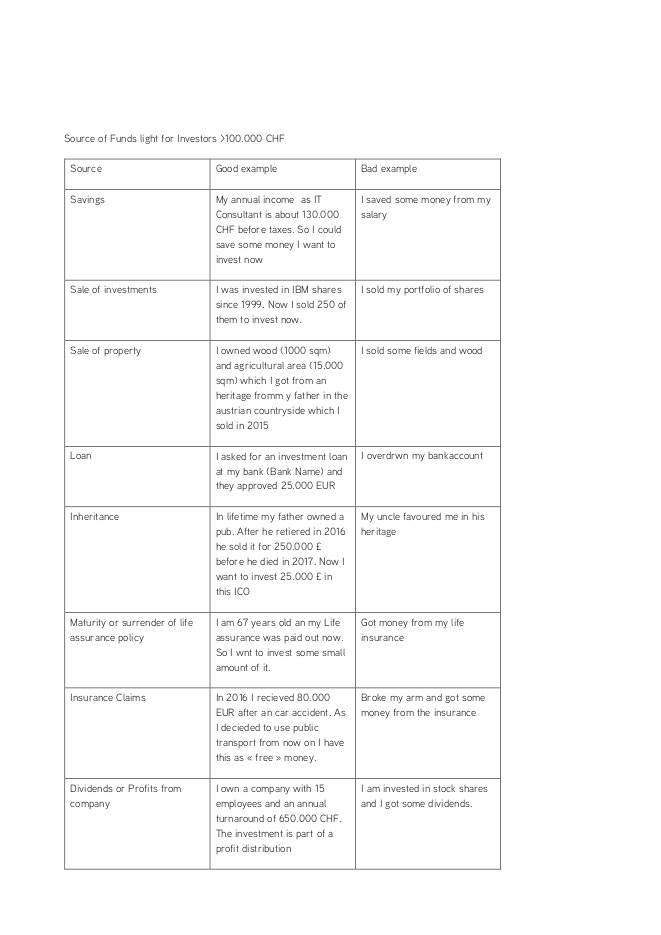

Source of funds

Please make sure that if you fill the source of funds that you are as detailed as possible. You can access the list with this link.

Do you have any questions with regards to KYC as potential Investor? Reach out to us via email, telegram or phone we are there to help.